"For three billion people, the global financial system is a complete failure." - Michael Schlein, CEO of Accion

Around 3 billion people do not have access to even the most basic financial services that we take for granted - like an account, credit or insurance. It is almost impossible for people to get out of poverty when everything has to be paid with physical cash.

Without access to credit, the poor are unable to plan for the future.

Credit worthiness is built on financial history of the borrower. This determines not only the ability to get credit, but also the fees and interest applied to the loan.

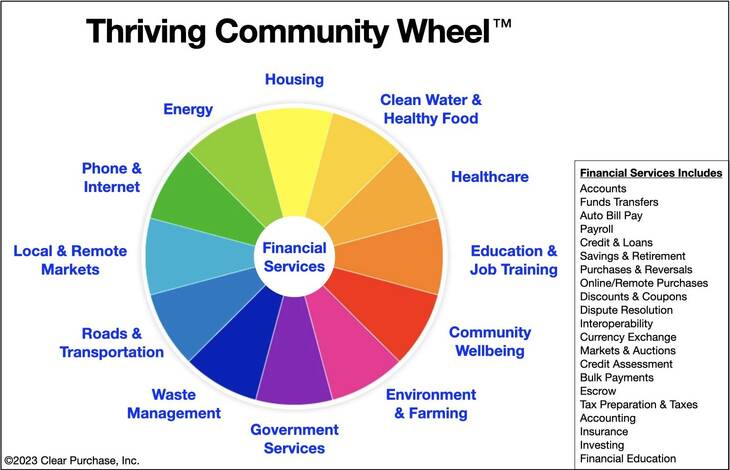

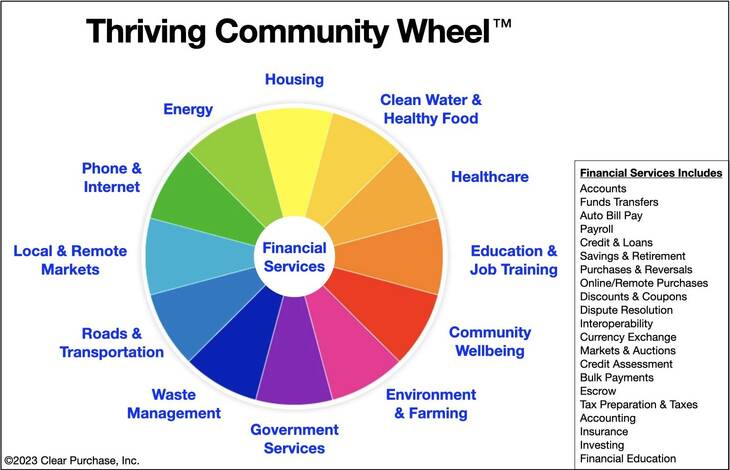

Our mission is to break this Poverty Trap by creating a fully Electronic Economy. The goal is physical cash is no longer necessary, especially for those living on as little as $2 per day.

A Payment Switch is needed so that everyone can transact with everyone else, regardless of where they have accounts.

It must be possible for poor people to do their every-day transaction electronically, otherwise they will still do everything in cash.

There is a global initiative called Financial Inclusion, which is focused on making Financial Services available to the poorest people on this planet.

There have been great advances in the last decade. Even the poorest people on this planet now have a cell phone, and most have access to Mobile Money on their phone, or soon will. However, this is not enough, as people are limited to only transacting with others who also have an account with the same provider.

The next logical step is to connect these Mobile Money systems so that anyone can transact with anyone else. This is called Interoperability.

Interoperability is extremely complex and incredibly risky, and should not be attempted by anyone who does not have sufficient relevant experience.

Our founder Nick Brown is a technical expert in exactly these types of systems, one of the few people who has worked across the entire breadth of payment infrastructure.

His reason for founding

1: No Poverty, eliminating a barrier trapping people in poverty.

8: Good Jobs & Economic Growth, by streamlining remote/electronic payroll and purchases, available to the poor. Includes International Remittances.

9: Innovation & Infrastructure. Clear Purchase is Infrastructure. We also make it possible for the poor to become a viable market for new innovation.

We also impact most other SDGs: 2, 3, 4, 5, 6, 7, 10, 11, 12, and 16.